Since June 2018, there have been announcements that Greece is set to exit the 3rd Economic Adjustment Programme it has been placed in since August 2015. Overall, Greece has been under the financial assistance from the European Commission since 2010 with recurring Programmes. As the country exits the memorandum, many profitable opportunities to invest arise.

This exit has been interpreted in different ways and with diverse predictions for the country’s future and it is important to see both sides of the coin.

As aptly put by professor Lorenzo Codogno, in a post in LSE’s blog, it is crucial to understand the motives behind the desire for a “clean exit”. On one hand, the current government wishes to express the positive sentiment of finally exiting a painful chapter for the country and fixing the mistakes of a previous government. In the same manner, the European Commission is looking to demonstrate how the recipe of economic reform has indeed lead to improvements. Looking at the positive side on the other hand, it is mentioned that with a well planned post-programme dept relief there will be a favourable climate for Greece to return to normalcy.

Similarly, George Georgiopoulos, in an article in Reuters, highlighted how the Greek government is “still facing daunting challenges”; however, mentioned how tourism is flourishing, while unemployment rates are decreasing.

Putting this into context and in relation to investment consultancy, this sign of economic improvement can mean the following for people interested in investing in Greece:

When it comes to investing in real estate, again we have two sides of the same story. On one hand homeowners have gained confidence in negotiating and have reluctantly started to ask for slightly higher prices. On the other hand, before the exit has any tangible effects on the economy, Greek investments such as properties will continue to remain undervalued, signifying a well-timed era for International investors to make the most of the market.

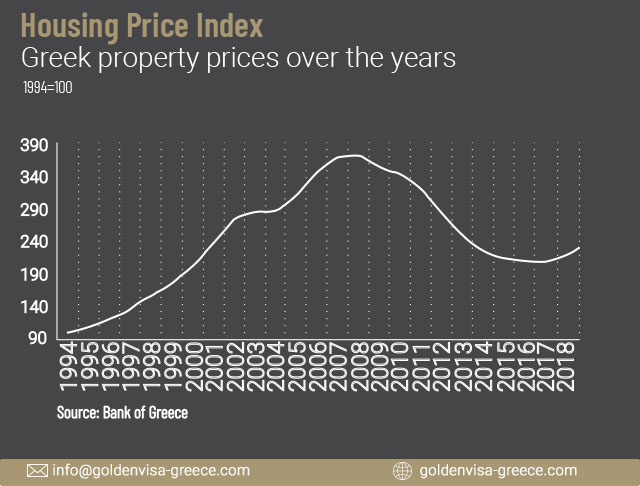

This can be better explained with a graph of the Housing price index, illustrating the last 24 years of the Greek real estate market which naturally also reflects the general state of the economy for each year as well. (Note, the steep fall in prices in 2008, when the economic crisis broke out).

Complimenting this, we have homeowners who were reluctant to put their properties on the market due to the very low average prices are now finally releasing them to be sold. This has lead to remarkable opportunities for renovation and properties in superb locations, which were previously unavailable.

Our observation is that there is an amazing change of sentiment, significant mobility and intense activity in the Greek real estate market with properties exiting the market as soon as they enter. It is definitely not too late to invest, since as mentioned above, properties are still immensely undervalued.

Adding to the above phenomena, with an ever-increasing number of tourists rental yields from short term lettings are skyrocketing allowing investors to maximize their rates of return despite the economy not having recovered fully.

It is important to note, that the Greek Golden Visa Programme, by nature, was built and implemented with the core purpose of boosting the economy and making it easier, more attractive and lucrative for investors, inviting people from all over the world to have an active role in shaping Greece’s economy.

If you are interested to invest in Greece and also benefit from a permanent residence permit that allows you to travel freely in 26 European countries, please do get in contact with us so we can discuss investment opportunities, solutions and plans.

Sources of Economic commentary mentioned in this article:

Article by George Georgiopoulos in Reuters

Artible by Lorenzo Codogno in LSE Blog

Images: Housing price index from the Bank of Greece, graph re-created by our team.

Cover Photo of sky through buildings by Steven Erixon on Unsplash

Please, if you wish to use our material, make sure it is for non-commercial use and kindly include a link to our website. Thank you.