Strategic Momentum Drives Greece to the Forefront of Global Investment

Greece is rapidly establishing itself as one of Europe’s most attractive investment destinations, with record-breaking inflows in real estate and tourism. Backed by progressive policies, rising global interest, and a thriving Golden Visa program, the country is drawing substantial attention from high-net-worth individuals (HNWIs) and institutional investors worldwide.

Surging Foreign Investment in Real Estate: A Transformative Decade

The Greek real estate market has seen a dramatic transformation over the past decade. In 2013, real estate accounted for just 7.4% of total foreign direct investment (FDI). Fast forward to 2023, and the sector captured a staggering 47% of total FDI inflows, amounting to €2.1 billion. This significant leap underscores growing international confidence in the stability and profitability of the Greek property market.

The country’s robust Golden Visa program has played a pivotal role in driving this growth. With over €4.47 billion in revenue generated since 2022 and 9,411 new applications filed in 2024—an 11% year-on-year increase—Greece is positioning itself as a global leader in residency-by-investment initiatives. Notably, the minimum property investment threshold has been adjusted in high-demand zones like Athens, Mykonos, and Santorini, pushing interest toward emerging regions and diversifying growth.

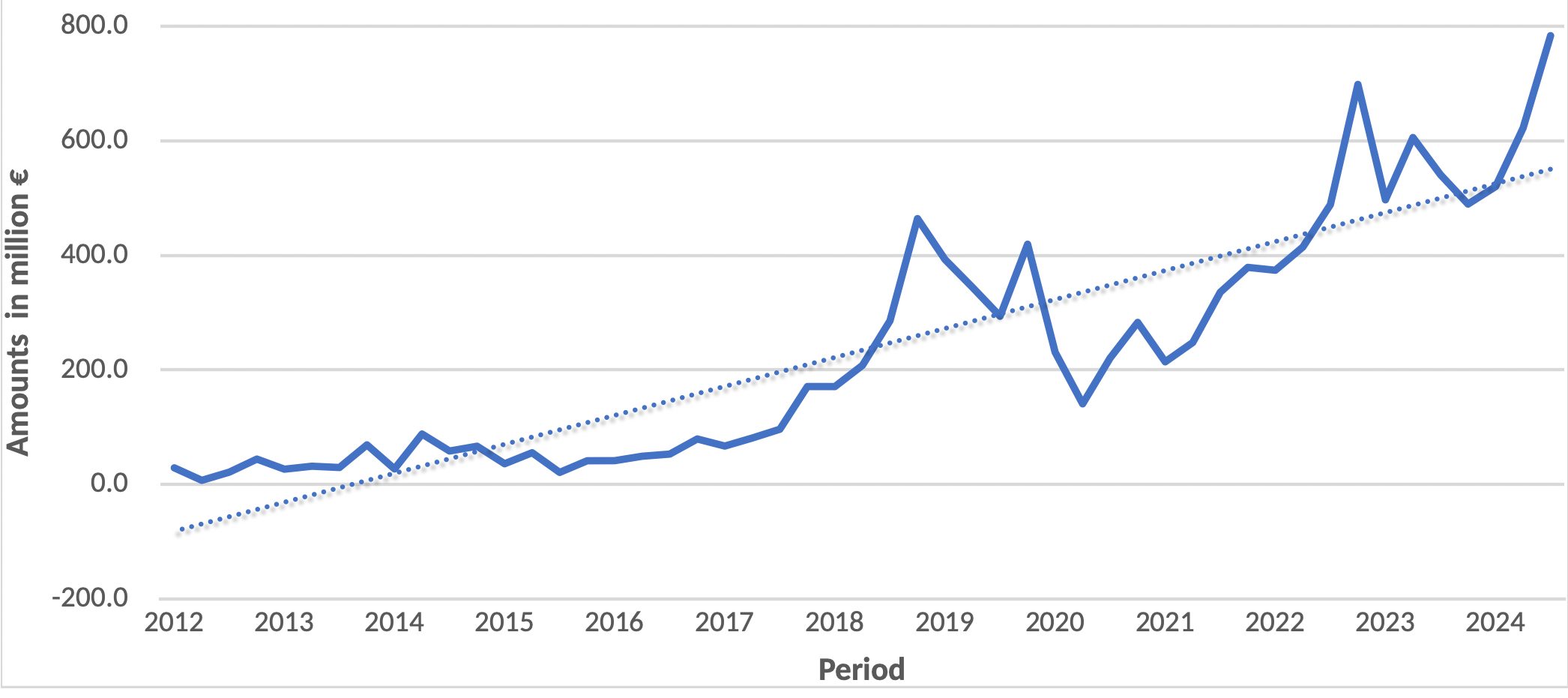

Net Foreign Direct Investment in Greece: Real Estate

Source: Bank of Greece

Luxury Real Estate: Greece Climbs the Global Ladder

Greece’s luxury real estate market is booming, buoyed by competitive pricing, picturesque locales, and government-driven investment incentives. In 2024, Net World Wealth ranked Greece among the top ten destinations for net inflows of millionaires, trailing only the UAE and the U.S.

Key luxury hotspots such as the Athens Riviera, Mykonos, Crete, and Santorini are witnessing double-digit property value appreciation. For instance, prime properties along the Athens Riviera experienced an 8% surge in 2024 alone. There is a notable uptick in demand for exclusive estates with sea views, private beach access, and proximity to elite marinas, international schools, and healthcare facilities.

With the global luxury real estate market expected to hit $1.34 trillion by 2025 (Statista), Greece’s value-for-money proposition and rich cultural tapestry make it a premier destination for discerning investors and lifestyle buyers alike.

Tourism: Strategic Projects Reinforce Global Standing

Tourism, a cornerstone of the Greek economy, is undergoing a significant upgrade. The Greek government recently approved over €1.2 billion in strategic tourism investments, fast-tracking major projects across Evia, the Peloponnese, and Western Greece. These developments are set to enhance Greece’s offering in high-end travel experiences, create thousands of new jobs, and improve regional infrastructure.

Greece recorded 35.9 million foreign arrivals in 2024, generating €21.7 billion in revenue—a record performance. The country’s travel surplus rose to €18.9 billion, up from €18.2 billion in 2023, further cementing its position as a Mediterranean tourism powerhouse.

The expanded investment program which together with the partnerships so far exceeds €2.3 billion redevelopment of Athens’ former airport at Ellinikon into a smart, sustainable coastal city and the expansion of five-star resorts by global brands like Mandarin Oriental and Four Seasons demonstrate a clear commitment to upscale and sustainable tourism.

Looking Ahead: A Safe Haven for Strategic Global Investment

Greece’s appeal as a stable, high-return investment hub is not a short-term trend but a long-term strategic shift. With political stability, pro-investor reforms, tax incentives, and a focus on economic modernization, the nation is firmly on the radar of global investors.

As the global economy seeks resilient opportunities, Greece presents a rare blend of historical charm, geographic advantage, and financial foresight—making it an ideal choice for real estate developers, institutional funds, and individual investors seeking high-quality, future-proof returns.