Following the announcements by the Greek Minister of Finance, on 02.04.2024 the Greek Parliament passed a new law, which introduces significant changes to the investor permanent residence permit.

The provisions of the new Law (L 5100/2024), amend the article 100 of Law 5038/2023 and establish new requirements for citizens of third-countries who invest in property in Greece in order to obtain a permanent residence permit. The new rule introduces the dual-zone system for real estate transactions and is effective as of August 31, 2024.

New Golden Visa Requirements

As of 31.03.2024, the new rule for minimum acquisition value of property for the purpose of granting the residence permit is set at €800,000 in the Region of Attica, Thessaloniki, Mykonos and Thira as well as on the islands with a population exceeding 3,100 residents.

For the other regions of the country, where the amount of investment had remained at €250,000, in accordance with the previous legal framework, the minimum acquisition value of the property will be increased to €400,000. In case of investment in structured property or property for which a building permit has been issued, a minimum area of 120 sq.m. of main premises is required.

| Golden Visa Real Estate Investment Threshold (valid from August 31st, 2024) | ||

| Amount | Quantity | Regions |

| €800,000 | One single property (120 sq.m) | Region of Attica, Mykonos, Santorini, Thessaloniki, islands with a population exceeding 3,100 |

| €400,000 | One single property (120 sq.m.) | Rest of the country |

In addition, the minimum acquisition value is set at €250,000, regardless of the location of the property and without a minimum surface area of the investment property provided by law, in the following cases:

(a) investment property whose main premises are changed into a residence,

(b) investment property consisting of an industrial building, provided that no industry has been established and operating therein for at least five years; and

(c) investment through the purchase of a listed building to be restored.

In cases (a) and (b), the change of use must be completed prior to the submission of the application for a permanent permit. It is also should be noted that, for the conversion of industrial buildings to residential, the industrial unit must have ceased its activity for at least 5 years. In case (c), it is provided that any transfer of the property before completion of its full restoration or total reconstruction is considered null and void. Completion of restoration or reconstruction is also required for the first renewal of the residence permit.

Restrictions *

- According to the Law 5038/2023, investors retain the possibility to lease their property. However, short-term leasing as well as the sub-leasing of the property is prohibited. It is also forbidden to use this property as a registered office or branch of a business. In case of non-compliance with the above provisions, the residence permit is revoked and an administrative fine of € 50,000 is imposed.

- In the event of change of use of an existing building, the property may not be used as the registered seat of a business or entity, under penalty of administrative fines and withdrawal of the golden visa.

- The investment must be made in a single property of at least 120 sq.m., not a number of smaller properties adding up to the threshold value of €800,000 or €400,000, as the case may be.

* It must be stressed that the law doesn’t specify whether this restriction applies to properties already acquired under the golden visa legislation or whether it is limited to future acquisitions (and relevant residence permits). Nevertheless, it appears that this provision is not intended to affect existing properties, acquired under the previously applicable regime and/or properties acquired within the transitional timeframe provided. Official clarifications are expected to tackle the grey areas arisen from the new laws.

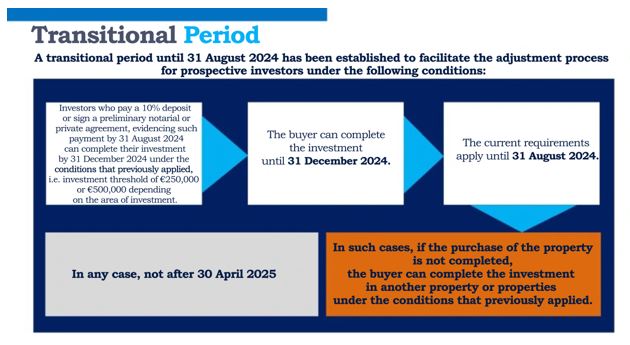

Transitional Period

An interim “protective” period is set until 31.12.2024, during which investors are allowed to complete their investments under the previous regime. To avail themselves of this option, investors must make an advance payment amounting to at least 10% of the investment or pay the price or rent or execute a notarial preliminary agreement or sign a private agreement of certified date and provide relevant proof of credit, by August 31, 2024. If the investment is not concluded by this deadline, investors may still complete their investment in another property under the previous regime, with the final deadline set for April 30, 2025.

Third-country nationals who finalize payment, pay a 10% deposit, or sign a pre-contract or private purchase agreement, substantiated by relevant documentation, can complete their investment by 31st December 2024, under the existing conditions.

In cases where property purchases are not finalized, investors may opt for another property, subject to the previous conditions, but no later than 30th April 2025.